How could you deal with children who leave but are still on the family “payroll”? At what point do you end the funding?

Oct 01, 2023 by Anthony Damaschino

I’m at risk of submitting a non-answer for this question because this varies so much by individual and family. I know parents who continue to support and supplement their adult children's lifestyle while others financially cut off their children at age eighteen.

Keeping your children on the financial payroll is a choice, but the choice isn’t necessarily easy. There are many considerations that a parent has to make with continued funding decisions. For example, having your child pay for their cell phone might be considered an easy decision, whereas If your child was in a situation where they would be homeless without your support, it is not so easy.

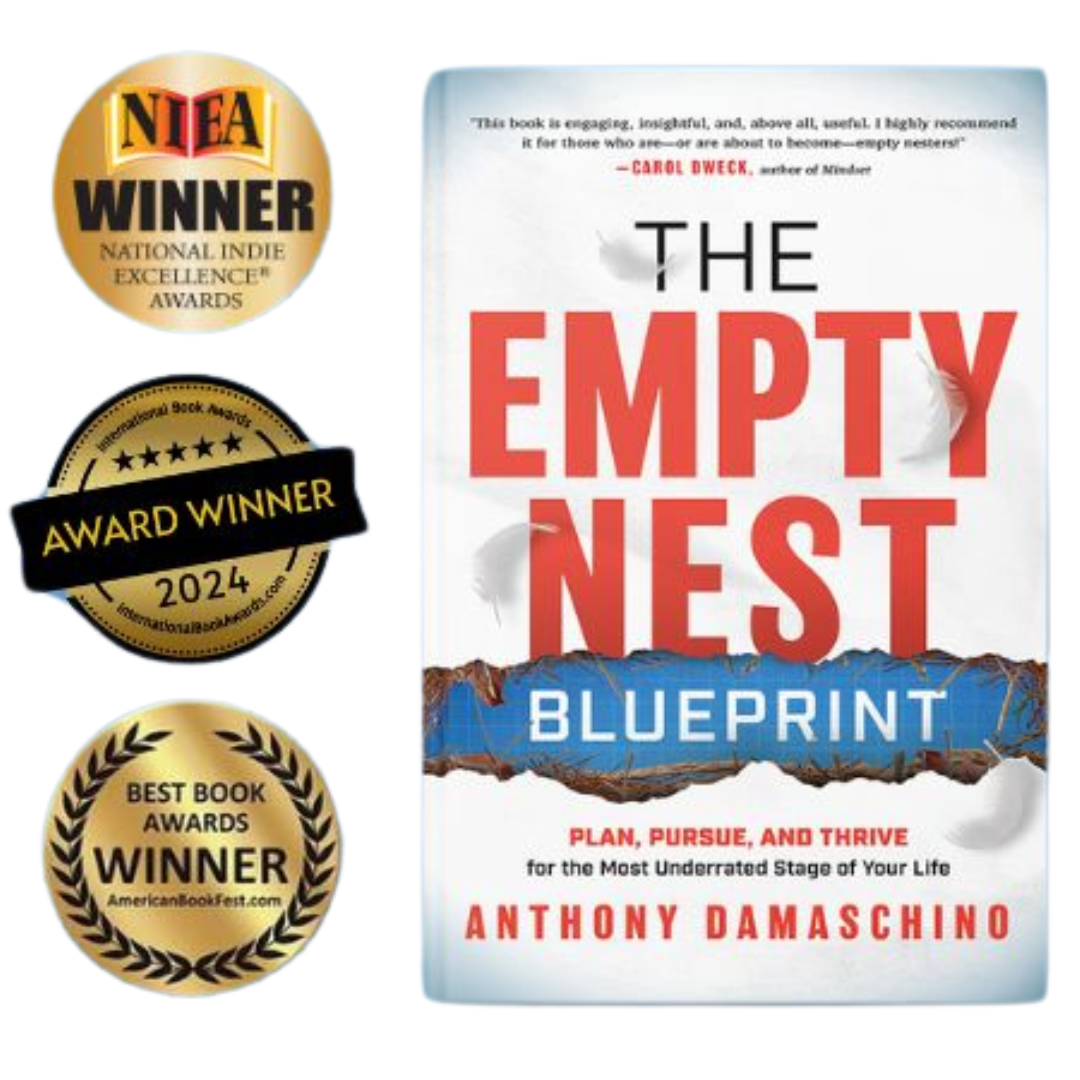

In Chapter Three of The Empty Nest Blueprint, titled The Average Empty Nester, I walk the reader through a summary of data and statistics on not only the average Empty Nester’s lifestyle, finances, and opinions, but I also cover Empty Nest spending on adult children. For example, it may surprise you that 79% of Empty Nesters provide continued financial support to their adult child. The cell phone bill is the number one supported adult child expense, followed by rent, groceries, and student loan payments. There is a lot in the book on this subject. Surprisingly, something as generic as global timing can make a big difference in whether you support your child. For example, my son graduated when the COVID pandemic peaked, and we were on lockdown. Few companies were hiring. He needed a longer timeline to support himself financially. In contrast, two years later, my eldest daughter had a job lined up upon graduation.

At the highest level, I believe the goal for most parents is to help their child become financially independent. For some, this may take on the form of encouraging financial education, saving, and intelligent lifestyle choices. It may be about setting boundaries and expectations around finances and having a job for others. For other parents, there may be an excellent situational reason to support or not support their child financially. So, rather than stating an age or blanket answer, I believe the best plan is to set goals and expectations with your child before they are independent so they know what is expected of them. Ideally, they take the lead on becoming financially self-sufficient in a reasonable time.